CHESS Replacement – It’s not about CHESS

There's been a fair bit of negative press about ASX and CHESS recently - in David Ferrall's view, it's all missing the key point. Check out his article to see why.

Criticism directed towards the ASX about CHESS replacement is missing some important points.

First, Australia’s unique market microstructure – that will enable rapid uptake of digitised securities – is a direct result of ASX’s decision almost 30 years ago to promote direct ownership of listed securities via the Holder Identification Number (HIN).

Secondly, the real prize in shifting to distributed ledger technology (DLT) is the shift away from custody, representing a huge step change in the way we invest and delivering massive benefits to end investors.

And thirdly, the most vocal critics are those that will lose the most – what we call the ‘wagon wheel’ of service providers sitting around financial markets adding layers of fees.

HIN was a very early herald of direct individual investment capability. The current blockchain and crypto craze is an interesting period in our history but it is masking the real prize – shifting assets away from custody and into directly held tokens sitting on the DLT.

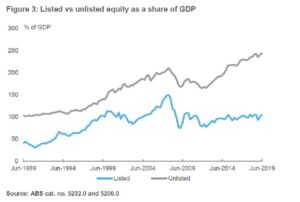

Today, ASX has around USD $2 trillion of assets on HIN. But this is not the norm. Zoom out, and you’ll find USD $250-300 trillion of securities held in custodial solutions around the world in markets where there is no HIN capability. When the DLT revolution comes – and it is coming – the savings and benefits to end investors from moving out of custody will be truly mind boggling.

ASX & CHESS replacement

Almost thirty years ago, the ASX made a revolutionary decision that now sets the scene for the next digital revolution – the widespread tokenisation of securities.

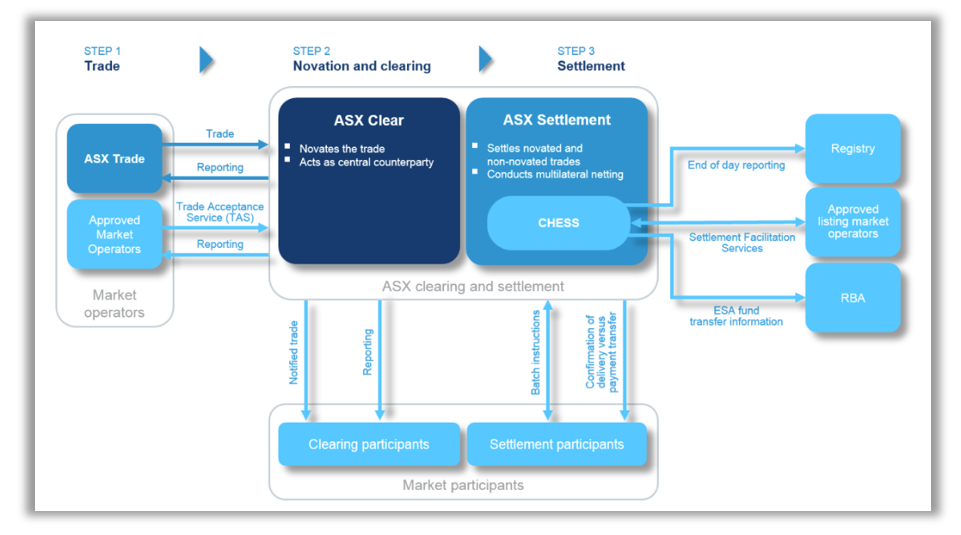

CHESS, and in particular the HIN, is why Australia has a globally unique market microstructure. Its importance has been covered previously – see here for a refresher.

While it is yet to be implemented, and I recognise not without its challenges, the decision ASX made six years ago to upgrade CHESS to a DLT messaging protocol represents a great opportunity that is either vastly misunderstood or ignored.

In many ways this decision is what ‘closes the circle’ of the current CHESS capability and, through smart contract capability, it will transform our current securities ecosystem bringing profound efficiencies and ultimately pricing benefits to retail investors.

More specifically, the upgraded DLT messaging capability will challenge the traditional custodial platform structure and therefore challenge the traditional revenue streams for custody centric platforms.

As an example, the bps fees charged on notional value of listed securities – which rise as the securities rise in value even though the platform is not performing any further value-added services – will become a thing of the past. See here for further information on the layers of fees traditional platforms charge.

The real opportunity, however, lies with the DLT itself and its capacity to tokenise securities via smart contracts, host other assets, or even collapse the whole heritage infrastructure (and fee structure) that supports the current listed securities ecosystem.

The future of platforms – front book/back book

When I think of the future of platforms, I look at our children and imagine how, with their ‘always on’ 24/7 mobile device connectivity and instant gratification/reward expectations, they will interact with future platforms for investments, financial advice and wealth management.

Already, with the rapid uptake of crypto assets and tokens via digital wallets, we get a view into that future. A world where assets are held directly in a digital wallet, and transaction times, account balances and holdings are measured in seconds or less.

Do we really think our current and future generations will be comfortable transacting and holding listed securities in a traditional custody wealth platform that is not able to facilitate the digital experience? The answer is a resounding no. This is why many of the fintechs building new advice models and forward thinking platforms are using API’s to connect to infrastructure and listed markets technology that enables and supports the digital experience.

When I look at the future of platforms, I think of it as a ‘front book/back book’ dynamic.

The ‘back book’ is the current ecosystem of traditional, independent custodial platforms. They have been very successful (and will continue to be in the short term) due to the enormous flows out of bank platforms. However, their cumbersome offering is not conducive to attracting the new generation of investors.

And for now, these traditional platforms probably don’t care – because the back book is so large, the short-term prize is so high, and the new generation of young investors have not yet accumulated enough wealth to make them interesting.

But the real prize is in the ‘front book.’ This is where new investment and wealth products will be delivered faster, more directly and much more efficiently to this rising generation of young investors, via improved real-time technology capabilities and tokenised securities.

Tokenised securities are simply securities – whether existing or new asset classes – that sit on a distributed ledger and allow the automation of functions such as transfers, corporate actions and notifications via an embedded smart contract capability. It is this capability that has the potential to collapse the many touch points and layers of fees that have built up within traditional financial services.

When we think about the future of platforms and the front book, we think of it as a digitally connected ecosystem where investors hold all their assets (both listed and unlisted) in their own name via a secure, authorised and permissioned digital wallet, with service providers interacting and communicating with that wallet to deliver specific advice, reporting and transaction capabilities.

Importantly, in this ecosystem, each provider only charges for the services they actually deliver – none of this charging a bps fee on the ‘value’ of a wallet.

We call this the ‘doing’ platform, versus the back book ethos of ‘let us hold all your assets in our custody’ solution, where you lose the benefits of direct ownership and pay an over- inflated bps fee on the value of all your assets.

Custody vs tokenisation/digitisation

Let’s not kid ourselves here – custody is a massive global industry, owned by big global investment banks and financial institutions, catering to an industry that is addicted to fees. Custody, as a solution to reporting assets on a consolidated basis, evolved to meet a genuine need many decades ago. It has served advisers well, and likely will continue to for some time.

But digital, tokenised and direct investments are the way of the future, and investment banks know this. Most are now (as a priority) building for the future, while protecting their current revenue streams until they have worked out how to monetise the new world.

At present, tokenised assets are mostly confined to crypto and NFTs, but there are many fintechs, particularly in the gaming and derivatives industries, looking at the current listed markets as a huge disruptive opportunity.

The problem? Regulation. Listed markets are, thankfully for retail investors, incredibly tightly regulated. Regulators are still only beginning to think about a new, decentralised, digital economy which is only now being fully comprehended with Web3. So, until regulators work out how to regulate, oversee and protect this new world, current infrastructure will remain. But for how long?

Here in Australia, we are very fortunate to have a major head start. To go back to my first point about the ASX and CHESS, digital, direct securities have been a capability for almost 30 years here, albeit with the world of custody platforms built up alongside. Now, with CHESS 2.0 pending, and the resulting capability to tokenise securities into a centralised, trusted, regulated environment, Australia will once again be at the forefront of financial markets innovation.

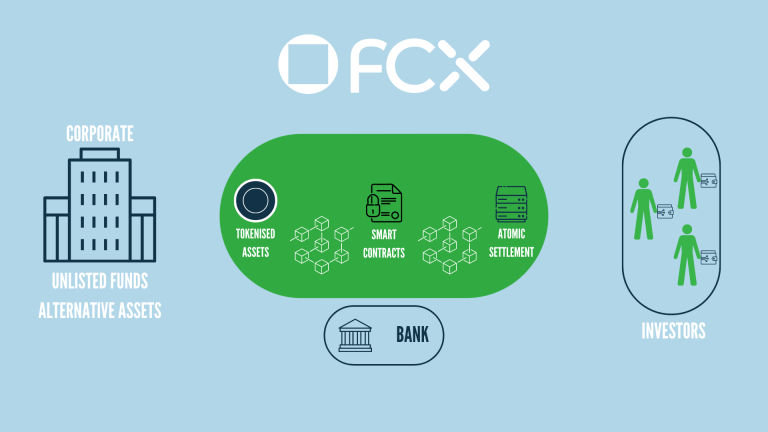

FinClear and FCX- the bridge

FinClear already works in highly regulated traditional markets. We are also using DLT to develop products that tokenise new kinds of securities, that will sit alongside current listed securities on HIN.

We see the ASX CHESS replacement as a massive opportunity to accelerate this process – but we are not dependent on it. We have already built our own distributed ledger, FCX, and have an exciting roadmap to develop this with more functionality and more asset classes.

We are building a connected, highly regulated investment world of direct securities that are all in the client’s own name, direct to register, rather than the old world of bundling all their assets into custody.

FinClear is the bridge between the old back book world and the future front book world. Using new technologies and capabilities, but coming from a highly regulated, trusted and highly capitalised position, we are uniquely placed to bridge the old world and the new.

We have already moved our own FinClear share register onto FCX, where investors will be able to see their unlisted FinClear shares; facilitate both primary and secondary liquidity events with instant settlement; and ultimately show liquidity via an exchange capability.

This will be the first platform of this type anywhere in the world.

Once delivered, and as other unlisted companies are welcomed on to FCX, investors will be able to see a consolidated view of all their listed and unlisted securities. From there, other asset classes, or even new listed securities, can be hosted on FCX. This will begin the predicted collapse of the back book into a more efficient digital, direct ecosystem. An ecosystem where other providers are welcome to connect to provide products and services for their end clients.

FCX will be a showcase for what the future of platforms should look like – and a model that we intend to expand globally.

Conflicted?

So are we conflicted in this debate? Hell yes!

Our business is built on providing a direct/HIN platform alternative to custodial platforms although it is also increasingly being used by some of these platforms that realise the benefits of non-custodial or directly held (HIN) securities.

We like to call ourselves the platform for platforms.

We could have built another custodial solution but chose not to. This would have ignored the inevitable shift globally to direct/tokenised securities and a capability that has existed in Australia since 1996.

So to the ASX, I say be very proud of how you have led innovation and continue to lead innovation in financial markets – stay firm and deliver a new capability and efficiencies that will ultimately transform all global markets.

And to the naysayers I say, stop protecting your own narrow interests and look to the future. Stop trying to protect your own revenue lines and think more about how you can use this technology to expand and develop adjacent and new business lines.

There is a USD$250+ trillion addressable market opportunity out there for those willing to have a go!

David Ferrall is founder and CEO of FinClear

FinClear signs long-term clearing agreement with Ord Minnett

FinClear has announced that it has agreed a new five-year contract to provide third-party clearing services to Australian wealth management group Ord Minnett.

FinClear, the Australian financial services and technology company, today announced that it has agreed a new five-year contract to provide third-party clearing services to Australian wealth management group Ord Minnett.

FinClear CEO David Ferrall said the deal, which encompasses both the current Ord Minnett business and the recently merged EL&C Baillieu, was a testament to FinClear’s client-friendly business model and a great endorsement for the group following the recent merger with Pershing Australia.

“When we bought the Pershing business we understood Ord Minnett were well advanced with plans to move to self-clearing,” he said. “I’m so delighted that after extensive discussions and due diligence with us, they have instead decided to stay. Ords is a mainstay of the Australian wealth management landscape and we look forward to serving them.”

Ord Minnett CEO, Karl Morris AO, said FinClear’s ability to work flexibly with the firm had been key to the decision.

“The FinClear team has been very approachable, and I was impressed with their determination to go the extra mile and deliver what was required to retain our business,” he said. “We believe FinClear will be an excellent fit for us going forward.”

The deal will see both firms working closely to integrate FinClear into Ord Minnett’s workflows, including bringing EL&C Baillieu specialist staff across to the FinClear team.

“We’re very excited to have the opportunity to access some of this country’s top operational talent as part of this partnership,” Ferrall said.

Established in 2015, FinClear offers a range of financial services technology solutions to clients from boutique financial advice practices to Australia’s largest banks. The company counts among its investors Magellan Financial Group and leading VC firm King River Capital, and acquired Pershing Australia in June 2021.

FinClear grows clearing business with Velocity Trade

The Australian financial technology company, FinClear, today announced that it will provide third-party clearing services to global broker-dealer Velocity Trade.

The Australian financial technology company, FinClear, today announced that it will provide third-party clearing services to global broker-dealer Velocity Trade.

FinClear CEO David Ferrall said the deal, FinClear’s first new third party clearing client post its recent acquisition of Pershing Australia, would present a number of synergies to both firms.

“Velocity is a global firm with great businesses and relationships in markets around the world,” he said. “We’re delighted to welcome them aboard, and I’m sure that our two businesses will find plenty of mutual value as our relationship develops.”

Velocity Trade Managing Director and Head of APAC, Spencer Davey, said FinClear’s reputation and breadth of services were a good fit for the business, which previously used UBS for its third-party clearing.

“FinClear has a well-established reputation in this market, and has also been very approachable and flexible in working with us to achieve our needs,” he said. “We are really looking forward to working with the team.”

Established in 2015, FinClear offers a range of financial services technology solutions to clients from boutique financial advice practices to Australia’s largest banks. The company counts among its investors Magellan Financial Group and leading VC firm King River Capital, and acquired Pershing Australia in June 2021.

Stake taps FinClear for trading, execution and clearing

FinClear has announced that it will provide trading, execution and clearing services via its API broking platform to low-cost equities broker Stake.

The Australian financial technology company, FinClear, today announced that it will provide trading, execution and clearing services via its API broking platform to low-cost equities broker Stake.

FinClear CEO David Ferrall said the deal was a testament to FinClear’s reputation as a trusted provider to the booming Australian fintech industry.

“We’re delighted that Stake has chosen the FinClear platform,” he said. “Because we’re the only company in our space to own the complete infrastructure highway – from the retail interface through to the exchange and clearing house – we’re able to really streamline the trading process and make it much more efficient than anyone else can.”

Stake CEO Matt Leibowitz said working with FinClear would provide Stake’s almost 300,000 Australian customers with the most efficient trading experience.

“We’re really excited to bring a more seamless and transparent way for investors to access the Australian equities market. Finclear shares our vision for where the local market can go and what is possible when you combine that with technology.”

“FinClear is progressive, innovative, and completely committed to giving their clients the highest quality access to markets. That aligns perfectly with what we do, so it’s an ideal partnership for us.”

FinClear’s API broking platform provides an extensive suite of API services including account establishment, order management, market and company data, and access to CHESS via FinClear’s proprietary technology.

Established in 2015, FinClear offers a range of financial services technology solutions to clients from boutique financial advice practices to Australia’s largest banks. The company counts among its investors Magellan Financial Group and leading VC firm King River Capital.

Tony Boyd, Chanticleer Columnist forThe Australian Financial Review, makes a valuable contribution to the crucial discussion on our national trading infrastructure – Australia could be at the forefront of new market infrastructure, given HIN is the forerunner to tokenisation, instead, we’ve waited seven years (so far) for an update to an outdated system.

We’ve demonstrated how it should work with our unlisted trading platform FCX. Watch this space for an upcoming live demo of fully tokenised bank-to-platform investment.