Clearing the Path: Unravelling the Power of Third-Party Clearing in Australia’s Financial Landscape

As Australia’s financial landscape evolves, FinClear’s extensive suite of products and services, fronted by our Third-Party Clearing (TPC) capabilities, is playing an increasingly critical role in maintaining the liquidity, efficiency, and transparency of our local markets. This article delves into what’s been driving the demand for TPC services and why FinClear’s significant investments in technology, coupled with its capacity and domestic market expertise make FinClear the ideal partner for any financial organisation looking to meet the demands of today’s complex market requirements.

TPC at its core is a utility business that underpins the daily workings of financial markets in Australia, with its primary focus being the provision of a resilient, scalable, and reliable service offering. Before getting into what sets FinClear’s TPC offering part from anyone else in the market, let’s take a closer look at how clearing and settlement is evolving and the impact on Market Participants.

Clearing & settlement explained

There are considerable workings involved in post-trade activities like Clearing and Settlement.

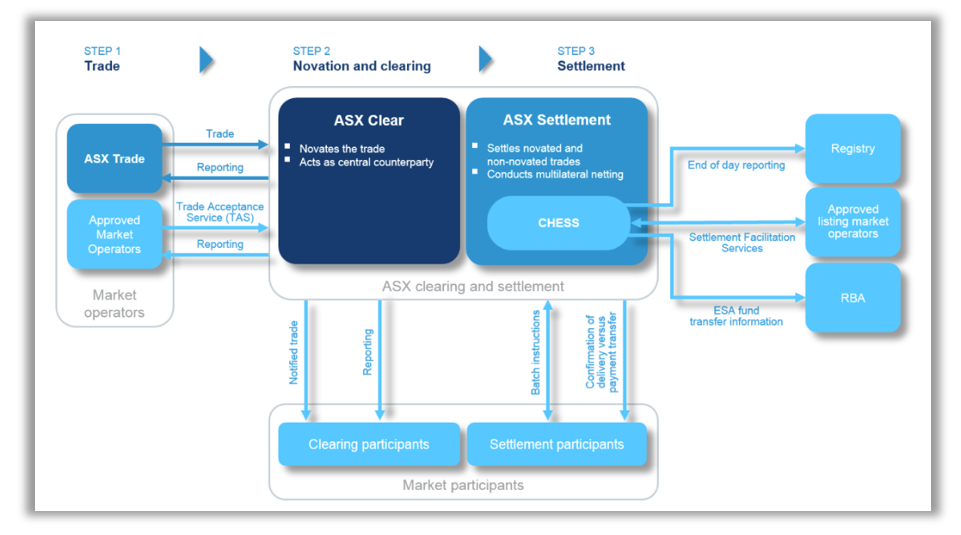

Clearing, which occurs right after a trade, determines what participants owe and are owed upon settlement.

Settlement is a two-way process which involves both the transfer of funds and securities to the ultimate beneficiary on the settlement date, which in Australia is two days after trade date (T2). Trades executed on the local markets are submitted to ASX Clear for registration, and once accepted by ASX Clear, by way of novation, each cash market trade is replaced with a netted cash market transaction between each Clearing Participant and ASX Clear. Settlement is then conducted through the Clearing House Electronic Sub-Register System (CHESS). CHESS is globally unique in combining settlement services with an electronic sub-register, used to record ownership of shares bought and sold (this is where the much-loved HIN comes into play) by clients of Market Participants.

In other markets such as the US, individual books and records are held by each clearing broker in custody rather than in the end clients’ own name.

Diagram showing the Clearing & Settlement process. Source: ASX

Third Party Clearing

Building on this explanation, TPC is when the Clearing and Settlement functions are performed by an external Clearing Participant for an independent (Third-Party) Market Participant rather than directly by the Market Participant themselves.

Outsourcing Clearing and Settlement to a Third-Party Clearing Participant (CP) might sound simple but the devil is in the detail. The CP not only takes on the operational responsibilities but also the regulatory requirements and responsibilities. Most importantly, the CP takes on the credit exposure of its clients, and their end clients, over the T2 settlement period. The CP is legally obliged to settle all trades novated to it regardless of whether cash or stock is received from the Market Participant. As such CPs are subject to stringent capital and liquidity requirements to undertake their role.

The combination of significant capital requirements and to the need to meet onerous legal and regulatory requirements is why Market Participants choose to outsource the process to TPC service providers such as FinClear.

Looking under the hood of a TPC business

A successful TPC business needs expertise, substantial capital ($20m+ only gets you in the door), significant capability, experience and know how to comply with the stringent regulatory requirements. It also needs solid technical capabilities and because it’s a low margin business with high capital requirements, to make this all worthwhile it needs scale. Lots of scale.

You can have the biggest balance sheet and the largest tech team out there but without business scale for this particular offering, this all just translates into financial cost and losses.

“Australian Made” is also a big factor in longevity. Over the eight years FinClear has been operating, numerous global players have entered the market; failed to get traction over a number of years, and ultimately exited. The overseas parent is then wondering what went wrong and any customers they might have picked up along the way are left high and dry.

There is no such thing as overnight success

Make no mistake, establishing a TPC business takes a significant amount of time. FinClear has been focused on third party clearing for over eight years, with the acquisition of the Pershing business in 2021 putting FinClear on the map, accelerating its growth and giving it the scale to become the leading TPC provider in the Australian market.

How FinClear’s tech strategy has evolved

For a tech-based utility provider like FinClear, having a robust technology framework to serve our clients’ needs and the multiple disciplines of its own business is of primary importance. FinClear prides itself in the strength of its tech stack and the extensive range of services it provides Market Participants and AFSL holders.

In today’s ever-changing markets, our technology strategy continues to evolve. Back in the early 2000’s the industry was vendor centric via self-clearing models and back-office systems were very ‘siloed’ in operation. At that time, FinClear took the view that offering a comprehensive clearing service had to be complemented by an in-house technology capability and was an early adopter for consolidation of technology systems and services through the acquisition of DION and iBROKER. FinClear also took the view that while the back-office connectivity was important, putting clients into clunky back-office systems was not the way forward and a better strategy was to invest in client friendly modern middleware, hence the decision to develop Trade Centre (TC) applications.

When the ASX CHESS replacement project was announced in 2015, FinClear intended to leverage ASX’s bold plans into a new technology stack which would ultimately replace iBROKER. FinClear’s acquisition of Pershing in 2021 provided the platform to quickly gain the critical scale required.

With the subsequent unravelling of ASX’s CHESS replacement project and recent updates confirming a diminished scope and prolonged timeline, FinClear will continue to maintain a link into ASX CHESS (which is not going to change substantially for years to come) by further developing its partnership with Broadridge. FinClear will consolidate its back-office activities into one system, being Summit) as well as continuing to invest in its TC platform. For clients who want more than a stand-alone utility TPC offering, FinClear’s additional services can provide important benefits and real advantages.

Additional products and services

Leveraging our position as the leading provider of TPC services in Australia, FinClear acts as an aggregator of services from the market and channels these through to our clients on better terms. This applies to services such as international trading, access to Fixed Income and other asset classes. We are currently running advanced beta testing of a FX offering to enable clients to move money around quicker and cheaper. We’re also developing a Cash Hub offering which will centralise cash on platform, supporting the investment lifecycle with FinClear, and will ultimately offer multi-currency digital wallets. More on this in the coming months.

Our TC trading platforms include desktop, web based and mobile trading applications for investment professionals. TCAdviser (or TCA) is our flagship trading product; a feature and data rich desktop trading application which provides an economical alternative to the market incumbent at a time where ongoing price hikes by incumbents are really hurting the industry. The growing market adoption of our TCA product shows many clients are now voting with their feet and adopting new systems in a bid to reduce ever-increasing operational costs.

Helping address digitisation, scale and driving efficiencies

TC also includes a middle office module called TCOps which helps a Market Participant’s operations team enhance day-to-day functions and take more control over the client’s experience, while still leaving the heavy lifting to FinClear. We’ll be releasing several new features in TCOps in the coming months along with a facelift to improve the user experience and system operability.

Integration to online, paperless account opening applications is available via existing partner integrations and we continue to invest into our post-trade support teams, systems and activities. This is critical to our core business and that of our clients.

We also have an extensive API suite which is used by our FinTech clients and more recently has been adopted by our Market Participant clients to enhance their client experiences and drive operational efficiencies. We’re seeing a significant shift from file-based data transfers to APIs.

Innovation

Our investment in and development of FCX is relevant as it’s not just about solving challenges for the private markets but also about leveraging our expertise and technology capability into a post trade ecosystem that manages the settlement and clearing functions in real time. With cash and stock locked on the platform and the ability to move cash in real time via the banking New Payments Platform (NPP), there is no need for a two-day settlement & clearing cycle. This product has the potential to completely revolutionise the settlement process and remove the significant capital costs associated to clearing.

The future is Clear

TPC continues to be a critical pillar for Australian markets infrastructure and one that FinClear remains committed to. We have invested significant expertise and capital over the last eight years to build Australia’s leading TPC offering, and we are committed to continuing this into the long-term. TPC is a dynamic, technically sophisticated service offering that generates significant value for FinClear and its clients. I have no doubt that it will continue remain at the forefront of change and innovation in Australia’s financial services for many decades to come.

Author: Andrea Marani, CEO of FinClear Execution & Clearing Services

Back to News

Back to News