What markets will we be able to trade?

Please see the table below for a list of available markets:

What counterparties will we be dealing with? Are my clients’ assets safe?

Velocity Trade is a leading global broker-dealer that provides customised traditional financial market services alongside integrated technology solutions to institutions, hedge funds, other broker-dealers and corporations the world over. Velocity uses Societe Generale Group and Fidelity as global custodians and this is where your client positions will be held.

What products/instruments we will be able to trade in?

You will be able to trade in listed equities, warrants and traded managed funds in the markets we have access to.

Can we use margin accounts?

No, we will not be offering a margin account service.

What are the prerequisites for opening an international trading account for my clients?

You can request an international account to be opened on behalf of your client by providing a client completed and signed, International account opening form, along with CRS & W8BEN form to clientonboarding@finclearservices.com.au

If my client has an existing FinClear account, will they need to sign new T&C’s?

Yes, clients will need to review and acknowledge the international T&C’s when they complete an international account opening form and associated documentation as mentioned above.

What is a W8Ben form?

W-8BEN is a US Treasury form that allows foreign investors to claim special tax treaty benefits, including a reduced rate of withholding tax. The W-8BEN form needs to be completed to trade US shares, this avoids a double taxation for clients.

How do we complete a W-8BEN form?

How do I access all Mandatory Forms?

Forms will be provided to your firm by the FinClear Services Operations team or your Relationship Manager.

What will be the annual process for updating IRS tax forms for Fully Disclosed accounts?

W8 forms expire every three years and need to be replaced during the third calendar year. For W8 refresh via a paper/PDF copy of the form there will be a $100 processing fee.

Will there be the ability to submit W-8 forms via an online portal?

Yes, we are working with our provider, Velocity Trade, to allow the submission of W-8 forms via an online portal although do not have an ETA at this stage.

How long does it take to establish an international trading account for my client(s)?

Your clients account will be available to trade in majority of cases within two days of completed documentation being provided, but on some occasions it may be longer depending on our international service provider and any additional data that may need to be confirmed to open the account.

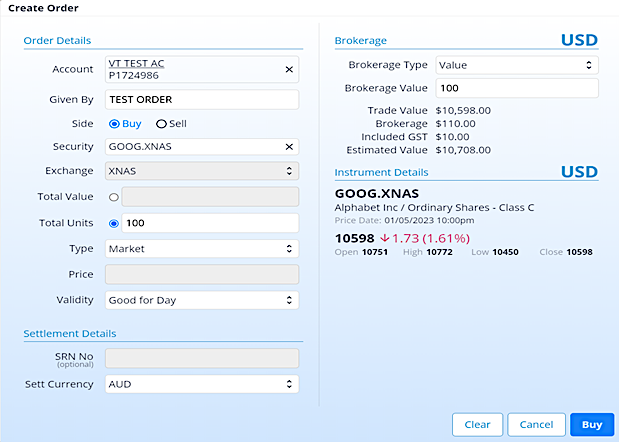

What order types will be supported?

Validity – Good For Day.

Type – Market and limit orders will be available but will be restricted to limit only for certain markets, mainly the quote driven markets like US OTC where only limit orders will be allowed for risk management purposes. Noting also that those quote driven markets will incur higher charges.

How do I place an international order with FinClear?

International orders will be placed by either TradeCentre Wealth or TradeCentre Adviser and routed over FIX to the appropriate exchange.

TC Wealth Order Pad

Is there a cost to international security prices via TradeCentre Wealth or TradeCentre Adviser?

Yes, $15 per month per TradeCentre Wealth or TradeCentre Adviser user is charged to access international security pricing.

Do I have, the ability, to view Security depth for international markets via TradeCentre Wealth or TradeCentre Adviser?

No, top line depth (Open, High, Low & Close) is only available.

Top Line Depth

Will you support bulk order placement and if so, how?

Orders can be submitted in Bulk by using the Bulk Order template available within TC Wealth.

Is there a user guide for the Bulk order template?

Yes it can be found within the Draft orders section of TC Wealth as a downloadable PDF

Can I use Algorithms (VWAP, TWAP etc) when placing International orders?

Yes, however as the functionality is not yet built into TradeCentre, orders that are required to be placed via an Algorithm need to be emailed to international@fincelarservices.com.au using the international order template and specific instructions by 4.30pm (AEST)

Are there additional charges for using Algorithms for orders?

Yes, please refer to your firms international trading agreement for pricing. Please note billing will be in arrears and included in your monthly billing pack and not applied at the point of trade.

How is Brokerage charged?

Brokerage will be charged in the denomination of the country traded. For example, if you are buying AAPL.XNAS and wish to charge $100 brokerage, this will be charged as $100 USD.

Can I trade through Iress, Refinitiv or Bloomberg?

No, trading can only be done via TradeCentre Wealth or TradeCentre Adviser.

Is there a cost to international security prices via TradeCentre Wealth or TradeCentre Adviser?

Yes, $15 per month per TradeCentre Wealth or TradeCentre Adviser user is charged to access international security pricing.

Do I have, the ability, to view Security depth for international markets via TradeCentre Wealth or TradeCentre Adviser?

No, top line depth (Open, High, Low & Close) is only available.

Can I place trades without paying the $15 per month for market depth?

No, international market data is required if you wish to trade international securities for your clients.

Will you support bulk order placement and if so, how?

Orders can be submitted in Bulk by using the Bulk Order template available within TC Wealth.

Are all securities on all approved markets available to trade?

Not immediately, while we have circa 3,500 securities set up to trade additional instruments need to be set up and configured to enable trading.

What is the process for setting up a new tradeable security?

All new security requests must be sent via email to international@finclearservices.com.au for review and approval. This process is the same whether it is for a new purchase or transferring an existing holding into our custody from another provider. Addition of new securities are on a case-by-case basis and can take between 24-48 hours to be active once approved.

How do I obtain a list of already set up and approved international securities?

Speak to the FinClear Execution team or email international@finclearservices.com.au

Are there restrictions on OTC Securities?

Yes, OTC securities need to be approved by FinClear, VT and the corresponding custodians to enable trading. In general, we do not allow addition or trading of low-priced securities (priced less than 1 cent per share) or securities that belong to the lower tiers of US OTC markets due to them being unable or unwilling to provide appropriate disclosures to the market.

Can new OTC Security set up requests be rejected?

Yes, OTC security requests may be rejected and is at the complete discretion of FinClear, Velocity Trade and the custodians.

Can I sell an international security prior to the security being transferred to FinClear (Velocity Trade)?

No, the international security needs to be held by FinClear prior to a trade being placed.

Can I buy odd lots in Hong Kong or Japanese markets?

All buy orders must be in line with the lot size of the security you are trading. If you have an odd lot due to a corporate action etc. and you are selling then we can sell all the odd lot balance in the odd lot market. Please note odd lot sales can only be done at market and any limit applied to the first part of your order will no longer apply.

Ie. If you hold 275 shares of 00700.XHKG which trades in round lots of 100 and you instruct for the entire holding to be sold with a limit price, the balance of 75 shares will be sold at market in the odd lot market if the first 200 shares are executed as per the limit price.

What currencies can we settle in?

All international accounts must settle in AUD only.

How will the FX rate be applied?

Velocity Trade or FinClear will manage all FX conversions from the traded currency to the settlement currency of the client account. All FX conversions will occur as soon as the trade is completed or immediately after the close of the local market if the trade is only partially completed.

When are Contract notes booked for International?

International contract notes are booked on T+1.

When will settlement be due for client trades?

The settlement timetable will be the same as it is currently, considering international timelines and holidays. Buy transactions will settle using the on T+2 and sell transactions will be paid to your clients on T+3, (assuming the traded market is settling on a T+2 basis).

Who are the Custodians holding the international assets?

Your clients’ international assets, with be held by Societe Generale Group and Fidelity or equivalent global custodian.

How will the custody fee be calculated?

The custody fee will be calculated daily based upon the last traded price of the securities being held on each client account.

When will the custody fee be applied?

The custody fee will be applied in the first days of the following calendar month. The fee will be charged to the Intermediary, and it will be up to each Intermediary to determine whether the fee is to be passed on to the end client.

Will custody fee be applied direct to the client’s account?

The fee will be charged to the Intermediary, and it will be up to each Intermediary to determine whether the fee is to be passed on to the end client.

How long does a DRS transfer take?

Typically these take up to 10 business days.

Can I transfer my clients international stock certificate into their account?

Yes, but the holding must have a minimum value of AUD $100,000, and each request is reviewed on a case by case basis.

How do I transfer international securities my client holds with another broker to FinClear?

You can complete (and send to Finclear) an International Securities Account Transfer Form, which can be found at Part E of the FinClear International Client Agreement.

Can clients exercise their voting rights for international securities?

Yes. While FinClear will not actively seek votes, if there is a particular event your client wishes to submit their vote, this can be sent to the FinClear Services corporate action team. The instruction must be sent at least three business days prior to closing date to allow enough time to pass the election to the custodian to action. The election will be processed on a best endeavour basis.

How are dividends paid to clients for international securities?

Dividends will be allocated to the appropriate client account with FinClear based on holdings as at record date and paid to the clients linked bank account.

Can my client elect to settle trades to a custodian of their choice?

No, all trades are settled with the Velocity Trade Custodians.

Who should I contact for further information about the international solution?

Please speak to your Relationship Manager in the first instance.

SERVICE DESK

EXECUTIONS

International Hotline: (02) 8039 9211

International Email: international@finclearservices.com.au

Bookings

Phone: (02) 8999 4015

Email: Bookings@Finclearservices.com.au

For Escalations – Bookings Lead: Nicholas.Cordingley@finclearservices.com.au

Cash

Phone: (02) 8999 4020

Email: CashSettlements@finclearservices.com.au

For Escalations – Cash Lead: Joanne.Yuen@finclearservices.com.au

Corporate Actions

Phone: (02) 8999 4027

Email: Corporate-Actions@Finclearservices.com.au

For Escalations – Corporate Actions Lead: Ante.Pervan@finclearservices.com.au

Scrip-Settlements

Phone: (02) 8999 4027

Email: Scrip-Settlements@Finclearservices.com.au

For Escalations – Scrip-Settlements Lead: Ante.Pervan@finclearservices.com.au

Stock Transfers

Phone: (02) 8999 4033

Email: Sponsorship@finclearservices.com.au

For Escalations – Sponsorship Lead: Ante.Pervan@finclearservices.com.au

Account Services

Phone: (02) 8999 4036

Email: ClientOnBoarding@finclearservices.com.au

For Escalation – Account Services Lead: Helen.Pink@finclear.com.au

Client Relationship Manager: sophia.skilbeck@finclear.com.au

Client Relationship Manager: jackie.moore@finclear.com.au