FCX Granted Historic Australian Market Licence by ASIC and RBA to Create the World’s First Regulated, DLT-Enabled Private Capital Market

Historic move provides global opportunity for private markets

- ASIC and RBA have granted groundbreaking licencing to FCX to trade and settle shares in private companies and units in managed investment schemes

- ASIC has taken a step in promoting competition in clearing and settlement of securities for the first time

- The move takes Australia from a financial centre laggard[1] to global leader as the first country to boast a fully regulated, ledger-enabled marketplace (outside limited sandbox environments)

Sydney, 8 October 2024 – FCX, Australia’s first platform for facilitating private market secondary transactions and a subsidiary of FinClear, has been awarded the first-of-its-kind Australian Market Licence and Clearing and Settlement Facility Licence by the Australian Securities and Investments Commission (ASIC) and the Reserve Bank of Australia (RBA), in respect of the trading and clearing and settlement of the FCX Market, making it the first fully-regulated platform for facilitating private market secondary transactions.

The licences enable the FCX Market to trade securities in private and unlisted public companies and interests in managed investment schemes, creating the world’s only distributed ledger-enabled, fully regulated private market.

Commenting on the Licences, David Ferrall, Founder and CEO of FinClear Group, said:

“We are delighted to have been granted Australian Market and Clearing & Settlement Licences and would like to thank ASIC and the RBA for their incredible support in making this happen. This is a pivotal moment not only for Australia’s private companies and capital markets but for financial markets globally.

“The Licenses set a new global standard for regulated private capital markets and are a significant step forwards for Australia’s financial infrastructure.

“FCX provides a ‘bridge’ from private to public delivering a fully regulated ecosystem for companies to utilise.”

ASIC has promoted competition

The Australian Market Licence makes FCX the first and only Tier 2 market operator for securities in Australia; while the Australian Clearing and Settlement Facility Licence makes FCX the first and only fully licenced alternative to ASX Clear and ASX CHESS in Australia. Together, these licences position FCX as the only operator other than the ASX to have complete market and clearing and settlement capabilities.

Following commitments from ASIC to promote competition and innovation of clearing and settlement services in the Australian market, this licence constitutes the first instance of allowing competitors to offer clearing and settlement services after the Treasurer legislated ASIC to do so late last year.

Establishing a regulatory solution for private secondary transactions

Demand from Australia’s largest private companies and their investors for a regulated and trusted market has never been greater. With over 50 companies already using FCX for better capital governance – cap table services, ESOP administration, capital raising and corporate action support – appetite for trusted and efficient liquidity solutions is high.

FCX Market comprises, for the first time globally, an integrated and regulated ecosystem which offers liquidity on demand, rather than daily liquidity, and is able to take companies from early to mid stage and onto a mature public listing. The FCX Market will give companies the ability to provide controlled liquidity solutions to shareholders and employees. For investors, it will provide liquidity, transparency, and security lacking in private assets until now – as well as direct access to an asset class historically out of reach for non-institutional investors.

The market will not operate continuously but will have liquidity events, as set by companies and managed investment schemes, with disclosure and operating rules governing the operation of market events.

FCX is currently working with ASIC to fulfil conditions of the licenses prior to operating the full market capabilities.

Cutting-edge tech for smarter automation

The FCX Market is built on Distributed Ledger Technology (DLT), recognised as the new standard in financial markets infrastructure, to conduct transactions with full digital automation for better transparency, accuracy and security, and significantly reduced settlement burdens.

DLT allows for more efficient and frictionless exchanges, without the need for multiple intermediaries – thereby realising efficiencies and reducing costs – while enabling more complex information and actions to be included in transactions, for example via ‘smart contracts’.

Global first

With Australia falling from being at the forefront of global financial market capabilities in the early 2000s, to outdated technology in recent years, especially in clearing and settlement, this development puts Australia ahead of all other countries and regions with the world’s first regulated market of its kind.[2]

Representing not only an Australian first but the first securities market globally to operate within regulatory ‘rails’ and offer atomic (i.e. instant) settlement capabilities underpinned by DLT, FCX opens the door to a global private market – allowing for connection between the US$13.1tn[3] private markets globally, thanks to the interoperability of the underlying DLT.

While other countries and regions have been experimenting with such technologies for longer, these primarily exist in restricted ‘sandbox’ environments subject to pressures from market forces, especially custodial intermediaries set to lose an expensive stranglehold over exchanges. The technology also offers a sophisticated T+0 solution for listed market issues, resembling what the CHESS replacement could be, and proving a resilient and scalable design.

Private markets soar

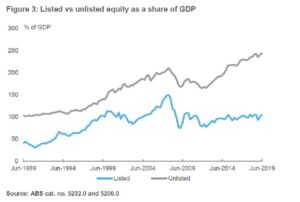

With public markets shrinking and concentrating in Australia and globally, while private markets surge, the need for regulated opportunities in the latter has never been higher. IPOs

on the ASX have hit their lowest ebb since the GFC and private capital has emerged as the fastest-growing asset sector.[4]

FCX meets the increasingly corporate and complex needs of private companies who wish to remain private, and investor desire for direct access to regulated private market opportunities that far exceed the $2.7tn securities on ASX.[5]

Yuval Rooz, Co-Founder and CEO, Digital Asset said:

“Private markets are a growing and increasingly important part of the global economy and are projected to reach more than USD 18 trillion by 2027.[6] They present tremendous opportunities for investors globally, but they have been underserved by legacy technologies. We’re excited to partner with FCX to support the digitisation of private markets on the Canton Network.

Traditionally, private markets have been constrained by manual processes and significant friction, but the exponential potential for these assets makes them a perfect use case for distributed ledger technology. This will ultimately increase the availability of capital through greater access for investors, increase transaction flow and liquidity, and ultimately unlock trapped economic growth.”

____________________

About the Terms of Licence:

An Australian CS Facility Licence and an Australian Market Licence are granted to FinClear Pty Ltd under subsection 824B(1) and section 795B of the Corporations Act 2001 and authorise the Licensee to operate a facility that effects the settlement of FCX market transactions, and operate the Market, for

- shares in a company; and

- interests in a managed investment scheme that is structured as a unit trust;

other than shares or interest that are able to be traded on a licenced market other than the FCX market.

The Licensee must not allow a person to participate in the Facility unless the person is a participant in the FCX market, and:

- the person is a wholesale participant that only deals in the FCX market on their own behalf; or

- the person is a retail participant that only deals on the FCX market on their own behalf and only participates in the FCX market to dispose of their financial products through the FCX market, but does not acquire any financial products through the FCX market.

See ASIC Gazette for full terms >

______________________

[1] From Laggard to Leader: Why the capabilities that power Australia’s Clearing & Settlement services are falling behind global leaders, and how we can get back to the front of the pack, Mandala Group

[2] “While global peers are moving to adopt newer technologies, Australia’s singular reliance on CHESS means it is currently constrained in its capacity to integrate emerging technologies into post-trade processes…[There is] opportunity for Australia to return to the global frontier by enabling the adoption of more innovative and efficient technologies, including distributed ledger technologies (DLT), in Clearing and Settlement services.

… Government and industry must work together to design a modernised regulatory framework that delivers reliable, stable, efficient and secure financial markets…allowing Australia to reclaim its former position at the global frontier of financial markets infrastructure.

There are three key phases to returning Australia to the global frontier of financial markets:

- Grant regulatory relief for new entrants in C&S markets.

- Enable interoperability amongst C&S systems.

- Evolve the market structure to ensure responsible competition in C&S markets.” From Laggard to Leader, Mandala Group

[3] McKinsey Global Private Markets Review 2024: Private markets in a slower era

[4] The death of IPOs is just the start. The whole world’s going private, AFR 4 Oct 2024

[5] “The value of unlisted equity has consistently exceeded that of listed equity.” Trends in Australian capital markets, Business Council of Australia, Oct 2019

“Australia ASX Market Capitalization: Domestic data was reported at 2,655,838.000 AUD mn in Apr 2024.” CEIC data, Australia ASX Market Capitalization: Domestic

[6] Private Markets – A Growing, Alternative Asset Class, S&P Global

Back to News

Back to News